Photo by Anne Nygård on unsplash

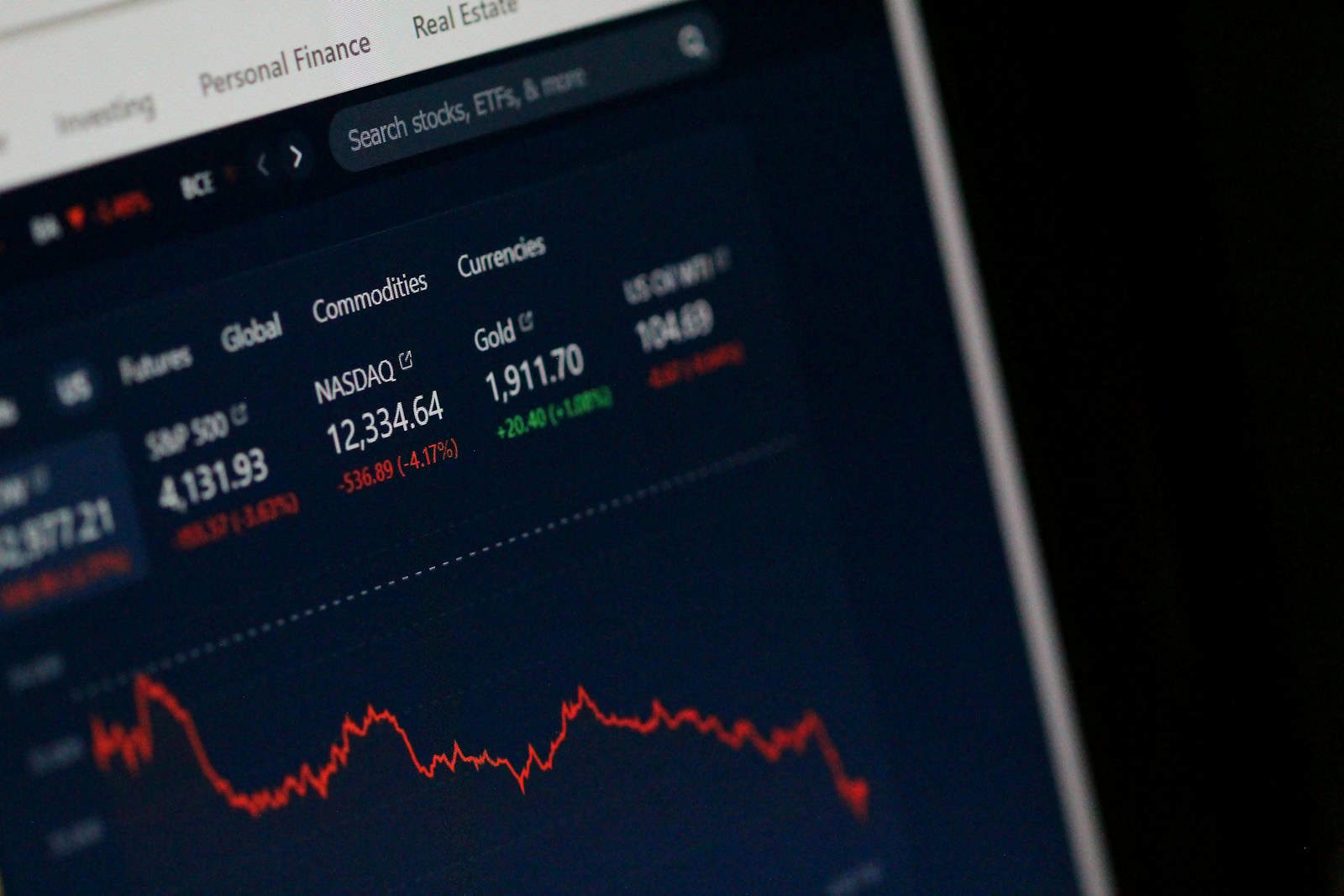

Stock Market Is Seeing Various Fluctuations

July 25, 2024

The stock market has taken a huge hit in various areas, negatively affecting the prices of shares across industries. Tech companies are experiencing the worst impacts, but the domestic automotive industry is suffering as well.

One key area of concern is the amount of spending being done by cloud computing companies. These specific companies, or hyperscalers, are hastily competing for the lead in artificial intelligence (AI).

There is a rising possibility that there will be slow returns on these investments, and this has investors worried. Many experts believe that the AI boom is just beginning, while others fear that predictions are rather excessive and exaggerated. Things are already shaping up to be another bubble burst similar to the .com era of the early 2000s.

For instance, Tesla has seen its profits shrinking, and Elon Musk has announced plans to focus on Neuralink, robotics, and AI development.

Furthermore, investors are starting to question Google’s $12 billion quarterly investment in AI. These investors are concerned about when exactly they will start to see returns on their investments. Recent analyses by prominent Wall Street banks and venture capitalists such as Goldman Sachs, Barclays, and Sequoia Capital raise doubts about the profitability of AI technologies. They contend that despite projections of annual investments reaching $60 billion by 2026, revenues may only reach $20 billion.

However, stocks have increased for companies such as Nvidia, Microsoft, and Alphabet.

Moreover, the automotive industry is seeing a huge shakeup. Ford’s shares sunk more than 17% in early trading on Thursday, making this the company’s biggest decline since 2009. In turn, more U.S. automakers have also been impacted and are facing scrutiny. Tesla has seen a slight increase since its recent decline. Previously, in the second quarter, Tesla’s U.S. EV market share dropped below 50% for the first time, falling from 59.3% to 49.7% year-over-year.

Recent News

Delta Seeks Outage Damages From Microsoft, CrowdStrike

The airline plans to sue both Microsoft and CrowdStrike for damages.

Sprouts Shares Positive Q2 Financial Results

Sprouts Farmers Market, Inc. reported robust second-quarter results ending on June 30, 2024.

Johnnie Walker Maker, Diageo, Posts Largest Sales Drop Since the Pandemic

As inflation and high interest rates force many to find ways to cut spending, it appears alcohol is also losing its buzz.

IKEA Focuses on Sleepeasy With New Pop-Up Event

IKEA U.S. is making new strides in the furniture retail market by launching The IKEA Sleepeasy, an immersive pop-up event that will take place in New York in August.